READ MORE

Receiving an inheritance is always a significant event, but when it comes in the form of real estate, it can be a game-changer for your financial future. Whether it’s a family home, a rental property, or a piece of land, inheriting real estate can open up a world of possibilities for pre-retirees. In this article, […]

October 26, 2023

READ MORE

You’ve just learned that you’re going to be inheriting real estate, which can be a significant windfall and an excellent addition to your retirement plan. However, before you start counting your blessings, addressing some concerns that pre-retirees should consider is crucial. This article will explore the top three concerns you must consider as you prepare […]

October 19, 2023

READ MORE

Retirement isn’t a one-size-fits-all concept. The traditional image of a planned exit from the workforce followed by leisurely days of relaxation has given way to a more tailored approach that focuses on individual aspirations, financial circumstances, and personal preferences. As you move towards this significant milestone, understanding your options can empower you to create a […]

September 5, 2023

READ MORE

As we grow older, we start thinking more about the income we’ll have in retirement. We want to ensure a comfortable and secure future. This is where working with a Retirement Income Certified Professional (RICP) comes in handy. The RICP designation is a professional certification program that focuses on retirement income planning. It is designed […]

July 6, 2023

READ MORE

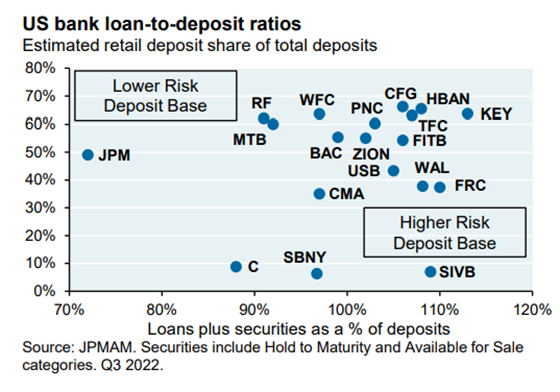

On Friday, March 10, 2023, Silicon Valley Bank was shut down by bank regulators. This piece is meant to be an overview of events. Note this is an event where next steps are being updated daily, so answers are subject to change. Information available as of March 13, 2023: What happened? Silicon Valley Bank (SVB) […]

March 28, 2023

READ MORE

If you use part of your home to conduct your trade or business, you might be able to deduct certain related expenses. To qualify for the home office deduction, you must pass certain tests. You must use part of your home regularly and exclusively for your trade or business. Exclusive use means that this space […]

March 28, 2023

READ MORE

What are some tax considerations associated with selling a vacation home? If you sell your vacation home and wish to know the tax consequences, you must first determine whether your residence qualifies as a vacation home in the eyes of the IRS. Assuming that it does, you should know how to treat capital gains and […]

March 28, 2023

READ MORE

What are the tax credits and deductions relating to higher education? There are two education tax credits — the American Opportunity credit and the Lifetime Learning credit — that provide some relief to families in the midst of financing their children’s college education. There is also a federal income tax deduction for individuals who are […]

March 28, 2023

READ MORE

What are tax credits? A tax credit is a dollar-for-dollar reduction of your tax liability. After you’ve calculated your federal taxable income and computed the tax on it, you can subtract any income tax credits that may apply to arrive at the amount of tax you must pay or the refund you’ll receive. What’s the […]

March 28, 2023

READ MORE

Bigger tax credit for start-up retirement plans. The SECURE Act improves the small employer pension plan start-up cost credit in three ways for tax years starting after 2022. First, it makes the credit equal to the full amount of creditable plan start-up costs for employers with 50 or fewer employees (up to an annual cap). […]