Estimated Read Time: 5 minutes

You want to retire comfortably when the time comes. You also want to help your child go to college. So how do you juggle the two? The truth is, saving for both your retirement and your child’s education at the same time can be a challenge. But take heart — you may be able to reach both goals if you start making some smart choices now.

The key takeaways are:

- Determining your financial needs?

- How do you balance retirement and college savings

- What if I can’t meet both goals?

Determining your financial needs?

To understand your financial needs for each goal, start by answering the following questions:

For retirement:

- How many years until you retire?

- Do you participate in an employer-sponsored retirement plan or a pension plan?

- How much will you have saved for retirement by the time you retire?

- How much do you expect to receive in Social Security benefits?

- What standard of living do you hope to have in retirement?

- Do you or your spouse expect to work part-time in retirement?

For college:

- How many years until your child starts college?

- Will your child attend a public or private college? What’s the expected cost?

- Do you have more than one child whom you’ll be saving for?

- Does your child have special skills that could lead to a scholarship?

- Do you expect your child to qualify for financial aid?

Many online calculators can help you predict both your retirement income needs as well as your child’s college funding needs.

How do you balance retirement and college savings?

After you know your financial needs, the next step is to determine what you can afford to put aside each month. To do so, you’ll need to prepare a detailed family budget that lists your income and expenses. Remember, though, that the amount you can afford may change from time to time as your circumstances change. Once you’ve come up with a dollar amount, you’ll need to decide how to divide your funds.

Though college is undoubtedly an important goal, you should focus on your retirement first if you have limited funds. With generous corporate pensions mostly a thing of the past, the burden is primarily on you to fund your own retirement. If you wait until your child is in college to start saving for retirement, you’ll miss out on years of potential tax-deferred growth and compounding. Remember, your child can always attend college by taking out loans (or maybe even with scholarships), but there’s no retirement loan!

In most cases, you will be able to save for both your retirement and your child’s college simultaneously. Meaning, that the more money you can squirrel away for college tuition now, the less money you or your child will need to borrow later. Even if you can only allocate a small amount to your child’s college fund, say $50 or $100 a month, you might be surprised at how much it will accumulate over time. For example, if you saved $100 every month with an 8% return, you could end up with $18,415 in your child’s college fund after ten years. (This example is for illustrative purposes only and does not represent a specific investment. Investment returns will fluctuate and cannot be guaranteed.)

If you are unsure about how to allocate your funds between retirement and college, a professional financial planner may be able to help. This person can also help you select appropriate investments for each of these goals. Be aware that while you are pursuing both goals simultaneously, that doesn’t necessarily mean that the same investments will be suitable. It may be more appropriate to treat each plan independently.

What if I can’t meet both goals?

If the numbers say that you can’t afford to educate your child or retire with the lifestyle you expected, you’ll probably have to make some sacrifices.

Here are some suggestions:

- Defer retirement: The longer you work, the more money you’ll earn, and the later you’ll need to dip into your retirement savings. Consider working part-time during retirement.

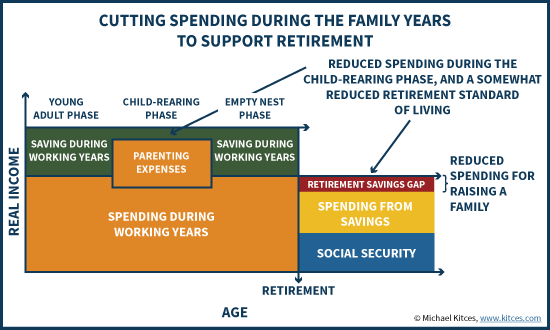

- Reduce your standard of living: You might be able to adjust your spending habits now to have money later. Alternatively, you may want to consider cutting spending during retirement.

- Increase your earnings now: You might consider increasing your hours at your current job, finding another job with better pay, taking on a second job, or having a stay-at-home spouse return to the workforce.

- Invest more aggressively: If you still have several years until retirement or college, you might be able to earn more money by investing more aggressively (but remember that aggressive investments mean a greater risk of loss). Note that no investment strategy can guarantee success.

- Choose a less expensive school: Your child may want to attend an Ivy League University, however, you may want to steer them towards a more affordable college of university that offers a similar major, or advise them to actively seek scholarships to fill the funding gap.

- Think of other creative ways to reduce education costs: Your child could attend a local college and live at home to save on room and board, enroll in an accelerated program to graduate in three years instead of four, take advantage of cooperative education where paid internships alternate with course work, or defer higher education for a year or two and work to earn money to pay for college.

- Expect your child to contribute: Despite your best efforts, your child may need to take out student loans or work part-time to in order to help pay for college.

- Having your child contribute is not a bad thing. There should be an expectation for them to have some skin in the game. My own children were responsible for 1/3 of their college expenses and they were able to make this work without taking on too much debt by seeking scholarships and grants to fulfill their contribution.

Can retirement accounts be used to save for college? Yes.

Should they be? That depends on your family’s circumstances.

Most financial planners discourage using retirement funds to pay for higher education. Especially if doing so could very well leave you with little to no funds left in your golden years.

However, you can certainly tap into your retirement accounts to help pay college bills if absolutely prudent. With IRAs, you can withdraw money penalty-free for college expenses, even if you’re under the age of 59½ (though there may be income tax consequences for the money you withdraw). Alternatively, with an employer-sponsored retirement plan like a 401(k) or 403(b), you’ll generally have to pay a 10% penalty on any withdrawals made before you reach age 59½ (age 55 or 50 in some cases), even if the money is used for college expenses. There may be income tax consequences as well. Definitely check with your plan administrator to see what withdrawal options are available to you regarding your employer-sponsored retirement plan.