Estimated Read Time: 4 minutes

As the last blog highlighted, the financial aid process is all about assessing what a family can afford to pay for college and trying to fill the gap. To do this, the federal government and colleges examine a family’s income and assets to determine how much a family should be expected to contribute before receiving financial aid, which is often much more than a family can actually afford.

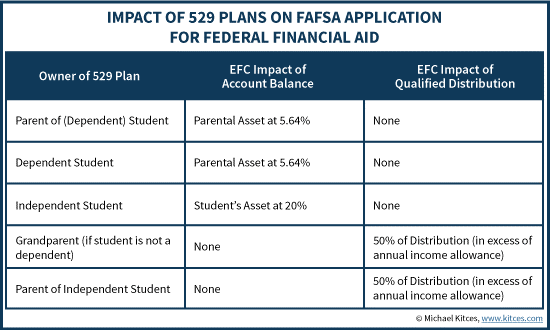

Financial aid formulas weigh assets differently, depending on whether they are owned by the parent or the child. College savings in the form of 529 Plans are a tool that parents can use to prepare for college tuition costs. They are assessed as part of the financial aid determination process. As a result, it’s important to know how your 529 accounts will be assessed because this will affect the amount of financial aid your child is awarded.

The key takeaways are:

- A Snapshot of Financial Aid

- Understanding how a 529 Plan is Affected by Financial Aid

- Understanding Grandparent-Owned 529 Accounts

A Snapshot of Financial Aid

Financial aid can consist of loans (which must be repaid in the future), grants or scholarships (which do not have to be repaid), and work-study jobs. The typical financial aid package contains all of these different types of aid. There are no guarantees that a larger financial aid award will consist of favorable grants and scholarships — your child may simply be awarded more loans.

The two main sources of financial aid are the federal government and individual colleges. In determining a student’s financial need, the federal government uses a formula known as the federal methodology whereas colleges use a formula known as the institutional methodology. The treatment of 529 accounts may differ, depending on the formula used.

How a 529 Plan is Affected by Financial Aid

Now that we understand what financial aid is, let’s see how a 529 Plan affects federal financial aid.

Under the federal methodology, 529 plans — both savings plans and prepaid tuition plans — are considered an asset of the parent so long as the parent is the account owner. Under the federal formula, a parent’s assets are counted at a rate of no more than 5.6%. This means that every year, the federal government concludes that 5.6% of the parent’s assets should be available to help pay for college costs. (By contrast, student assets are counted at a rate of 20%.)

There are a few things to keep in mind regarding the classification of 529 Plans as a parent asset:

- A parent is only required to list a 529 account as an asset if he or she is the account owner of the plan. If a grandparent is the account owner, then the 529 Plan doesn’t need to be listed as an asset. (see below.)

- Any student-owned 529 account also needs to be reported as a parent asset if the students is filing their FAFSA as a dependent student. Additionally, a 529 Plan can be a UTMA/UGMA-owned account when UTMA/UGMA assets are transferred into a 529 account on behalf of the same beneficiary.

- If your adjusted gross income is less than $50,000 and you meet a few other requirements, the federal government doesn’t count any of your assets in determining your EFC. So your 529 accounts wouldn’t affect your child’s financial aid eligibility at all.

Withdrawals from a parent-owned 529 account that are used to pay the beneficiary’s qualified education expenses aren’t classified as either parent or student income.

The formula is calculated on the FAFSA® (Free Application for Federal Student Aid), which I will discuss in another blog.

Understanding Grandparent-Owned 529 Accounts

Grandparent-owned accounts are not counted as an asset for either the parent or the student. However, withdrawals from a grandparent-owned 529 account are counted as student income on the FAFSA the following year. Student income is assessed at 50%, which means that a student’s eligibility for financial aid could decrease by 50% in the year following the withdrawal. Note: Starting with the 2024-2025 FAFSA, students will not need to report distributions from a grandparent-owned 529 plan. Students won’t be required to report any type of cash support.

Tips:

- To avoid having a distribution from a Grandparent-owned 529 account be considered as student income, a grandparent can delay taking a distribution from the 529 plan until any time after January 1st of the student’s sophomore year of college (due to the timing of filing the FAFSA which will be addressed in a later blog.)

- Alternatively, a student can wait and take a 529 distribution after they graduate and use the funds for student loan repayment (there is a $10,000 lifetime limit per 529 plan beneficiary on repaying student loans).

Bottom-Line:

It is important to consider when and how 529 withdrawals are made as they have the potential to impact financial aid in various ways. Knowing how your child’s 529 plan will be assessed is essential in minimizing the impact on college financial aid.